When it comes to investing in stocks, one of the most popular places for discussions, analysis, and information exchange is a company’s stock message board. For those invested in Roku Inc. or looking to get involved, the Roku stock message board is a hub for real-time updates and insights about the company’s stock performance, financials, and market trends. In this article, we will explore what a Roku stock message board is, how it works, and how investors can leverage these platforms to make informed decisions.

What is a Roku Stock Message Board?

A roku stock is an online forum or platform where investors and stock traders come together to discuss the stock price, news, trends, and strategies related to Roku Inc. The board provides a place for people to share insights, opinions, and predictions about Roku’s financial performance, making it a valuable tool for anyone interested in tracking the company’s stock.

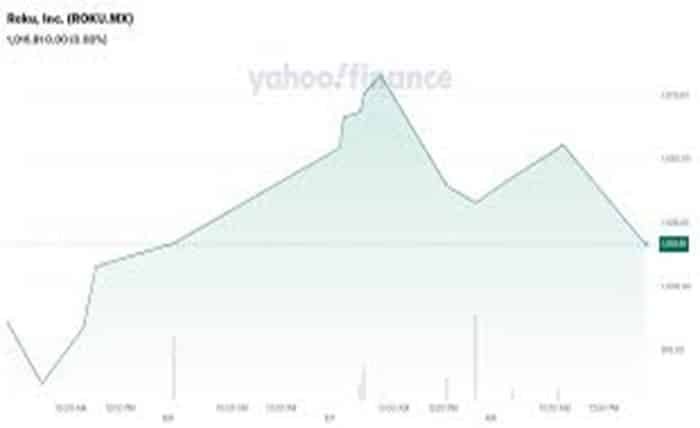

On a typical Roku stock message board, users can post updates about recent earnings reports, major announcements, product launches, or even rumors. Others may offer analysis or predictions about the stock’s future, sometimes offering a bullish or bearish outlook. Message boards like these can be found on several online platforms, including finance-focused websites like Yahoo Finance, MarketWatch, and Seeking Alpha.

How to Navigate the Roku Stock Message Board

Navigating a Roku stock message board requires understanding how to filter and evaluate the information that’s being shared. Since anyone can post, the quality of the posts may vary, ranging from detailed analysis to speculative opinions.

To make the most out of these platforms, investors should look for messages backed by data, such as historical stock trends, earnings reports, or news about Roku’s business. Additionally, staying engaged in the conversation by reading both positive and negative perspectives can help create a well-rounded understanding of the stock’s potential. Filtering out noise and focusing on credible sources is essential for getting accurate information.

The Role of a Roku Stock Message Board in Investor Decision-Making

A Roku stock message board plays a significant role in the decision-making process of individual investors. By engaging in discussions and reviewing the opinions of others, investors can gain valuable insights into the factors influencing Roku’s stock price. Whether it’s a discussion about Roku’s strategic partnership with other companies or a new product launch, these boards help investors stay informed.

Although a stock message board should not be the sole factor in decision-making, it can be an essential part of a broader research strategy. Many successful investors use message boards in conjunction with other tools like financial reports, professional analysts, and technical analysis to build their investment strategies. The discussions on a Roku stock message board can serve as a supplementary resource to validate or challenge an investor’s own assumptions.

Common Topics Discussed on the Roku Stock Message Board

On a Roku stock message board, discussions can cover a wide range of topics related to Roku’s business and stock performance. Some of the most common themes include:

- Earnings Reports: Users frequently analyze and debate the implications of Roku’s quarterly earnings reports, which can significantly affect the stock price.

- Product Releases and Innovations: Roku is known for its streaming devices and platform innovations, and announcements about new products often spark debates about how they will impact the company’s growth and stock value.

- Market Competition: Discussions often revolve around how Roku compares to competitors like Amazon Fire TV, Google Chromecast, and Apple TV, and whether it is positioned to maintain or increase its market share.

- Financial Analysis: Investors regularly share detailed analysis, including revenue trends, profit margins, and other key financial metrics that could influence Roku’s stock.

By participating in these discussions, investors can get a pulse on the current market sentiment surrounding Roku and stay updated on developments that may affect their investments.

Read more about : however synonym

Evaluating the Credibility of Information on the Roku Stock Message Board

Not all information shared on a Roku stock message board is reliable. As with any online forum, there are always a few users who post misleading, inaccurate, or unsubstantiated claims. This is why it’s important to assess the credibility of the information before making investment decisions.

A good practice is to cross-reference any financial data or news shared on the message board with credible news sources, official Roku press releases, and earnings reports. Additionally, it’s wise to look for insights from well-known analysts or experienced investors who have established credibility within the community. Investing based on a message board discussion without verifying the facts can be risky.

The Role of User Sentiment in the Roku Stock Message Board

User sentiment on a Roku stock message board can provide valuable clues about the market’s perception of Roku’s stock. Sentiment analysis involves gauging whether discussions are generally positive (bullish) or negative (bearish) and understanding the reasons behind them.

When the sentiment is overwhelmingly positive, it may signal confidence in the company’s future prospects, while a negative sentiment could indicate concerns about the stock’s potential or recent performance. Monitoring user sentiment can give investors a sense of the broader market mood and help them identify potential opportunities or risks before making trades.

Comparing the Roku Stock Message Board to Other Platforms

While the Roku stock message board offers valuable insights, it’s essential to understand how it compares to other stock discussion platforms. Popular alternatives like Reddit’s WallStreetBets, StockTwits, and Seeking Alpha provide additional perspectives on Roku’s stock.

For instance, StockTwits is a microblogging platform that allows users to post real-time comments with the option to tag stocks. Reddit’s WallStreetBets, on the other hand, is known for its volatile discussions and speculative nature, often driving short-term price movements. Comparing the sentiment and discussions from various platforms can help investors gain a more comprehensive understanding of how others view Roku’s stock.

Benefits of Participating in a Roku Stock Message Board

Joining a Roku stock message board has several benefits for individual investors. First, it allows users to stay updated with the latest news and trends related to Roku’s business and stock performance.

Second, it fosters a sense of community among investors, where they can share experiences, strategies, and lessons learned. Being part of such a community can also help investors remain motivated and informed, especially during periods of volatility. Finally, message boards provide a space to ask questions and seek advice from others who may have more experience with Roku’s stock or the stock market in general.

Risks of Relying Too Much on the Roku Stock Message Board

While Roku stock message boards can be a useful resource, relying too heavily on them can expose investors to certain risks. For example, the hype surrounding a particular stock or message thread can lead to impulsive decisions, such as buying or selling based on rumors or unverified claims.

Additionally, not all investors on these boards are objective. Some may have vested interests in driving the stock price up or down, which could lead to biased opinions. It’s important to use message boards as part of a broader research strategy rather than the sole basis for making investment decisions.

How the Roku Stock Message Board Impacts Market Trends

The discussions on a Roku stock message board can sometimes influence broader market trends. For example, if a large number of users suddenly express concerns about Roku’s financial performance, it could lead to a temporary drop in the stock price as other investors react to the negative sentiment.

Similarly, a positive thread that gains traction may attract more investors to buy Roku stock, potentially driving the price higher. While these effects may be short-lived, they demonstrate the power of collective sentiment in shaping market trends. Investors should be aware of the potential for market volatility driven by message board discussions.

Conclusion

A Roku stock message board is a valuable tool for investors looking to stay informed and engaged in discussions about Roku’s stock performance. While it can provide helpful insights into the stock’s potential and investor sentiment, it’s important to use message boards responsibly. Always verify information from credible sources and consider using these boards in conjunction with other research methods.

By navigating a Roku stock message board wisely and avoiding the pitfalls of misinformation, investors can make more informed decisions and stay ahead of market trends. Whether you’re a seasoned investor or a newcomer to the world of Roku stock, these platforms offer an opportunity to connect with like-minded individuals and enhance your understanding of the stock market.

FAQs

- What is the Roku stock message board?

The Roku stock message board is an online platform where investors discuss Roku’s stock performance, financial news, and trends. - How can I participate in a Roku stock message board?

To participate, simply join an online platform like Yahoo Finance or Seeking Alpha, find the Roku stock page, and start reading or posting messages. - Is the Roku stock message board reliable for investment decisions?

While message boards can provide valuable insights, it’s important to verify the information with credible sources before making investment decisions. - How do I evaluate the credibility of posts on the Roku stock message board?

Cross-reference information with official Roku reports, trusted financial news outlets, and expert analysts to verify its accuracy. - Can sentiment on a Roku stock message board affect the stock price?

Yes, discussions and sentiments on message boards can influence investor behavior and, in turn, impact short-term stock price movements.